We know that launching a startup is a load you take on your shoulders. However, keeping grip on numbers, along with other tasks, is difficult, and this is where CPA services for startups matter from day one.

Behind every great launch, you will find smart account management that streamlines numbers with business operations. How all this happens, let us walk you through it.

Why CPA Services for Startups is More Than a Choice?

You know that in a startup, you play many different roles initially. But keeping up with numbers takes time, which is difficult to manage initially. Here, a Certified Public Accountant (CPA) helps you build systems by analyzing data, predicting patterns, and preventing loss-making decisions even before they occur.

It is not about avoiding errors but building confidence. Further, when you approach investors for money, the transparent account system enhances your credibility and increases your chances of securing a deal.

Avoiding the Common Financial Pitfalls of New Businesses

We have seen that many businesses fail even with a good idea because they lack money management. When their books and cash flow are in opposite directions, disaster is inevitable. Other than that, their focus only remains on work and neglects account management, which then gets stuck in their neck.

Speaking statistically, last year, venture-backed startups shut down at a . This is not just data; it’s proof that without financial systems, the results can be business-damaging.

Here is where CPA services for startups bring ease for you by building transparent reporting systems and tracking expenses properly from day one. Besides, with their financial forecasting, you get the power to make informed decisions backed by the data.

Key Ways CPA Services Strengthen Your Startup

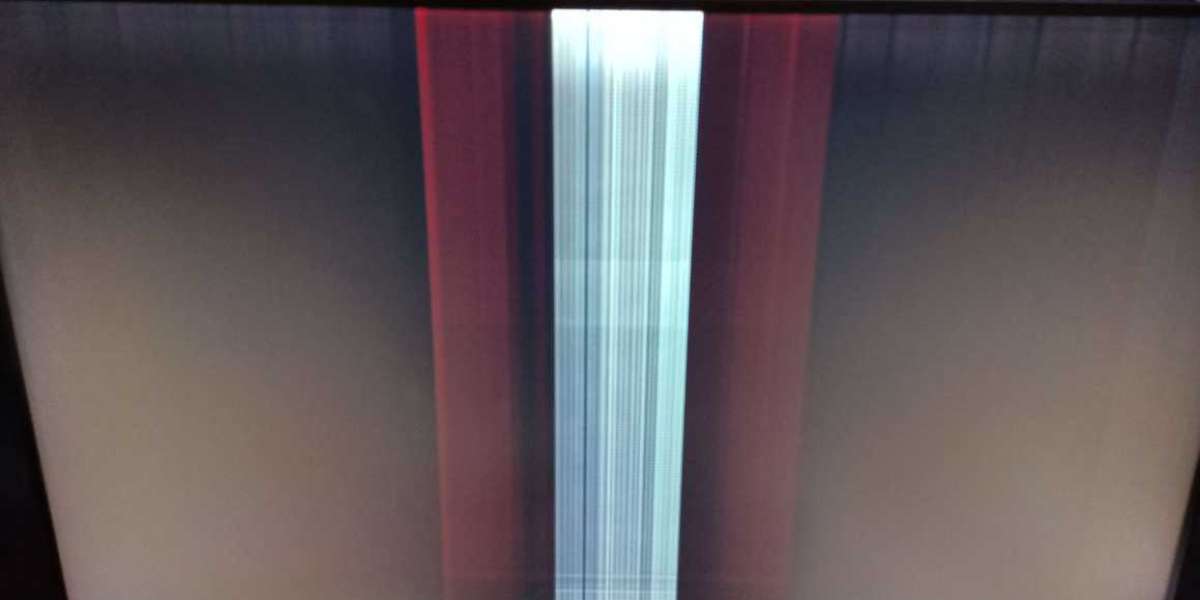

This image tells how CPA services for startups help in scaling

Here are the ways you get benefits from a CPA service:

- Set up proper accounting systems early.

- Create reliable cash flow forecasts.

- Track business expenses accurately.

- Guide entity formation and structure.

- Plan ahead for taxes and compliance.

- Provide tailored financial advice.

Building Investor Confidence with Clarity and Transparency

Investors want to see reports that are clean, compliant, and prepared with professional care. This is another area where CPA services for startups really matter. Properly prepared financial statements give potential investors confidence in you.

Don’t consider it as a formality; it is a book that tells your business's health and progress. Remember, trust attracts funding and also sets the path for partnerships.

Tax Planning That Supports Growth

It is a topic that every founder doesn’t want to discuss much, but also cannot ignore. Startups that don’t know how to optimize their processes often pay more than necessary. Here, a CPA who understands the startup ecosystem knows how to identify RD tax credits and structure business expenses properly.

Further, don’t confuse it with a filing because it is strategic advisory; you get to make smarter choices before tax season even begins.

So, if you have been managing taxes yourself or relying on generic software, it might be time to upgrade that strategy. For example, if you are self-employed or a founder, you can explore specialized guidance like that help you navigate quarterly estimates and deductions seamlessly.

Personalized Advisory That Scales With You

It is worth knowing that for you that no two startups are built the same. For instance, a SaaS company in Austin will not have the same financial model as a healthcare startup in Houston. Each industry comes with its unique cost structures, regulations, and growth patterns.

For Texas startups, it’s also important to stay aware of local compliance rules, from state franchise tax filings to understanding how your business entity structure affects liability and taxation.

That is why the best CPAs adapt according to your business rather than providing generic advice. They understand the ins and outs of your business and provide a tailored service optimized for your startup.

Managing Cash Flow and Budgeting

You can have strong sales and still run out of money if you are not managing timing, payments, and expenses wisely. That is where cash flow forecasting comes in with the help of a CPA. They help you understand hidden patterns that are affecting your business internally.

Also, know that budgeting is not cutting costs; it is about allocating resources to the right space and getting the most out of it. Think of it as giving your startup a financial GPS; you always know where you are and where you’re headed next. And when things shift, a trusted CPA can help you adjust in real time.

Value of Having a CPA on Your Side

Well, you may think that when I have software to manage my bookkeeping, why do I need a CPA then? Hearing this may appear right, but it is not. Software can automate bookkeeping and can handle basic reporting only. In contrast, a seasoned CPA brings financial insight, human judgment, and accountability.

You get an advisor who knows the patterns behind your numbers, who spots trends before they become problems, and who can look at your business operations in the real world. And for founders like you, balancing investor expectations, product deadlines, and team growth is an absolute must rather than a choice.

Final Thoughts

Every startup begins with passion, but sustainable growth takes time and happens only if you are strong in the financial domain. Smart accounting with CPA services for startups not only protects your business from loss but also accelerates its growth.

So, if you are ready to build that foundation the right way, consider working with a CPA like Zahra Samji from , which offers personalized, one-on-one financial advisory that helps founders across Houston and beyond make confident, informed decisions. Remember, when your accounting is smart, your startup is secure.